What Is The Property Tax Rate In Dekalb County Ga . Compare your rate to the state and. the dekalb county property appraisal department determines your property value. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. This responsibility is managed by the chief. the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. For example, in the city of dunwoody, which is. at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. property tax rates in dekalb county vary depending on where you live.

from www.templateroller.com

our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. Compare your rate to the state and. property tax rates in dekalb county vary depending on where you live. This responsibility is managed by the chief. For example, in the city of dunwoody, which is. the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. the dekalb county property appraisal department determines your property value.

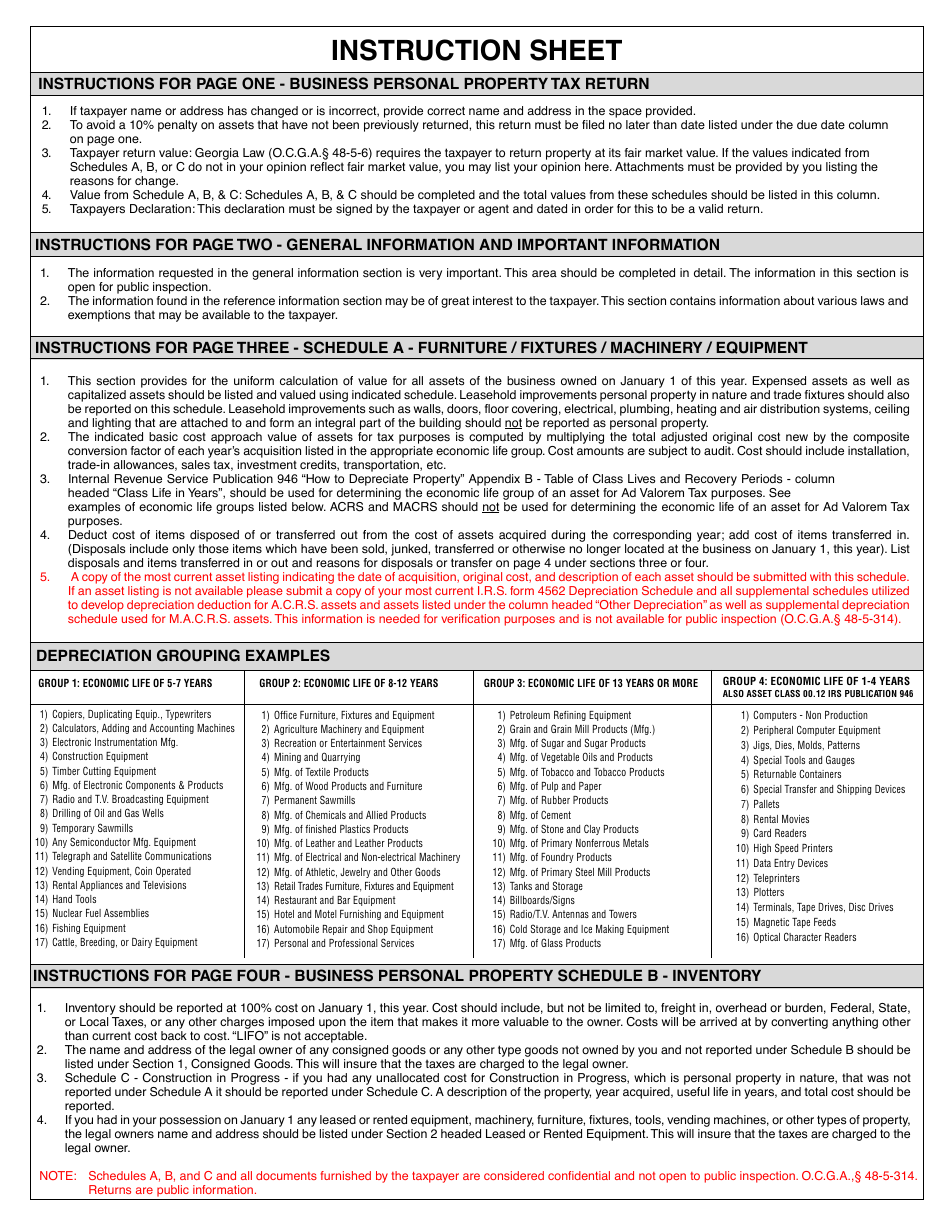

2023 DeKalb County, (United States) Business Personal Property

What Is The Property Tax Rate In Dekalb County Ga calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. This responsibility is managed by the chief. our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. property tax rates in dekalb county vary depending on where you live. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. For example, in the city of dunwoody, which is. the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. the dekalb county property appraisal department determines your property value. at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. Compare your rate to the state and.

From www.templateroller.com

2023 DeKalb County, (United States) Business Personal Property What Is The Property Tax Rate In Dekalb County Ga the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. our dekalb county property tax calculator can estimate your property taxes based on. What Is The Property Tax Rate In Dekalb County Ga.

From www.templateroller.com

2023 DeKalb County, (United States) Business Personal Property What Is The Property Tax Rate In Dekalb County Ga at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. our dekalb county property tax calculator can estimate your property taxes based. What Is The Property Tax Rate In Dekalb County Ga.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners What Is The Property Tax Rate In Dekalb County Ga Compare your rate to the state and. at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. For example, in the city of dunwoody, which is. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but. What Is The Property Tax Rate In Dekalb County Ga.

From dailysignal.com

How High Are Property Taxes in Your State? What Is The Property Tax Rate In Dekalb County Ga our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. For example, in the city of dunwoody, which is. the dekalb county property appraisal department determines your property. What Is The Property Tax Rate In Dekalb County Ga.

From www.youtube.com

DeKalb County Property Tax & Millage Rate Town Hall Video YouTube What Is The Property Tax Rate In Dekalb County Ga the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. property tax rates in dekalb county vary depending on where you live. Compare your rate to the state and. For example, in the city of dunwoody, which is. calculate how much. What Is The Property Tax Rate In Dekalb County Ga.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation What Is The Property Tax Rate In Dekalb County Ga the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. This responsibility is managed by the chief. Compare your rate to the state and. our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you. What Is The Property Tax Rate In Dekalb County Ga.

From www.dekalbcountyga.gov

Property tax payments DeKalb County GA What Is The Property Tax Rate In Dekalb County Ga our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. Compare your rate to the state and. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. property tax rates in dekalb county vary depending on where you. What Is The Property Tax Rate In Dekalb County Ga.

From en.wikipedia.org

DeKalb County, Wikipedia What Is The Property Tax Rate In Dekalb County Ga calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. at this site, users can view property information, pay property taxes for the. What Is The Property Tax Rate In Dekalb County Ga.

From koordinates.com

DeKalb County, GA Tax Parcels GIS Map Data DeKalb County, What Is The Property Tax Rate In Dekalb County Ga This responsibility is managed by the chief. our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. the dekalb county property appraisal department determines your property value. . What Is The Property Tax Rate In Dekalb County Ga.

From dekalbtax.org

DeKalb property tax first installment due Sept. 30 DeKalb Tax What Is The Property Tax Rate In Dekalb County Ga the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. Compare your rate to the state and. This responsibility is managed by the chief. our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you. What Is The Property Tax Rate In Dekalb County Ga.

From www.templateroller.com

2023 DeKalb County, (United States) Business Personal Property What Is The Property Tax Rate In Dekalb County Ga For example, in the city of dunwoody, which is. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average, but is still well below what. the dekalb county property appraisal department determines your property value. our dekalb county property tax calculator can estimate your property taxes based. What Is The Property Tax Rate In Dekalb County Ga.

From www.ajc.com

Property values in DeKalb County cities exceed unincorporated areas What Is The Property Tax Rate In Dekalb County Ga This responsibility is managed by the chief. our dekalb county property tax calculator can estimate your property taxes based on similar properties, and show you how your property. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. the median property tax (also known as real estate tax) in. What Is The Property Tax Rate In Dekalb County Ga.

From www.ajc.com

DeKalb County SPLOST frequently asked questions What Is The Property Tax Rate In Dekalb County Ga This responsibility is managed by the chief. the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. Compare your rate to the state and. the typical homeowner in dekalb county pays $2,845 annually in property taxes, which is higher than the $2,027 state average,. What Is The Property Tax Rate In Dekalb County Ga.

From www.fair-assessments.com

How a Dekalb County Tax Assessor Determines Property Values and Taxes What Is The Property Tax Rate In Dekalb County Ga This responsibility is managed by the chief. the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. the dekalb county property appraisal department determines your property value. at this site, users can view property information, pay property taxes for the current tax year,. What Is The Property Tax Rate In Dekalb County Ga.

From www.integrityallstars.com

2022’s Property Taxes by State Integrity All Stars What Is The Property Tax Rate In Dekalb County Ga This responsibility is managed by the chief. calculate how much you can expect to pay in property taxes on your home in dekalb county, georgia. at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. For example, in the city of dunwoody, which is. Compare your rate. What Is The Property Tax Rate In Dekalb County Ga.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation What Is The Property Tax Rate In Dekalb County Ga at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. Compare your rate to the state and. property tax rates in dekalb county vary depending on where you live. calculate how much you can expect to pay in property taxes on your home in dekalb county,. What Is The Property Tax Rate In Dekalb County Ga.

From www.dekalbcountyonline.com

City Of DeKalb 2024 Budget Supports Public Safety, Lowers Property Tax Rate What Is The Property Tax Rate In Dekalb County Ga at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. the dekalb county property appraisal department determines your property value. For example, in the city of dunwoody, which is. Compare your rate to the state and. property tax rates in dekalb county vary depending on where. What Is The Property Tax Rate In Dekalb County Ga.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills What Is The Property Tax Rate In Dekalb County Ga the median property tax (also known as real estate tax) in dekalb county is $1,977.00 per year, based on a median home value of. at this site, users can view property information, pay property taxes for the current tax year, apply for the basic homestead. Compare your rate to the state and. our dekalb county property tax. What Is The Property Tax Rate In Dekalb County Ga.